Permanent versus Term Life Insurance – What are the Differences?

Permanent versus Term Life Insurance – What are the Differences?

You know you need life insurance – but you’re not sure which kind is best for you. We can help you with that decision.

There are two main kinds of life insurance:

-

Permanent, which lasts for your entire life.

-

Term, which is only good for a set amount of time.

No matter which type of life insurance you buy – permanent or term – you can rest easy knowing you’ve provided financial protection for your family.

Permanent life insurance

Permanent life insurance is good for your entire life unless you choose to cancel it. It’s an excellent choice to help give you peace of mind that you’ll always be covered.

There are also benefits to having permanent life insurance beyond guaranteed lifelong coverage:

-

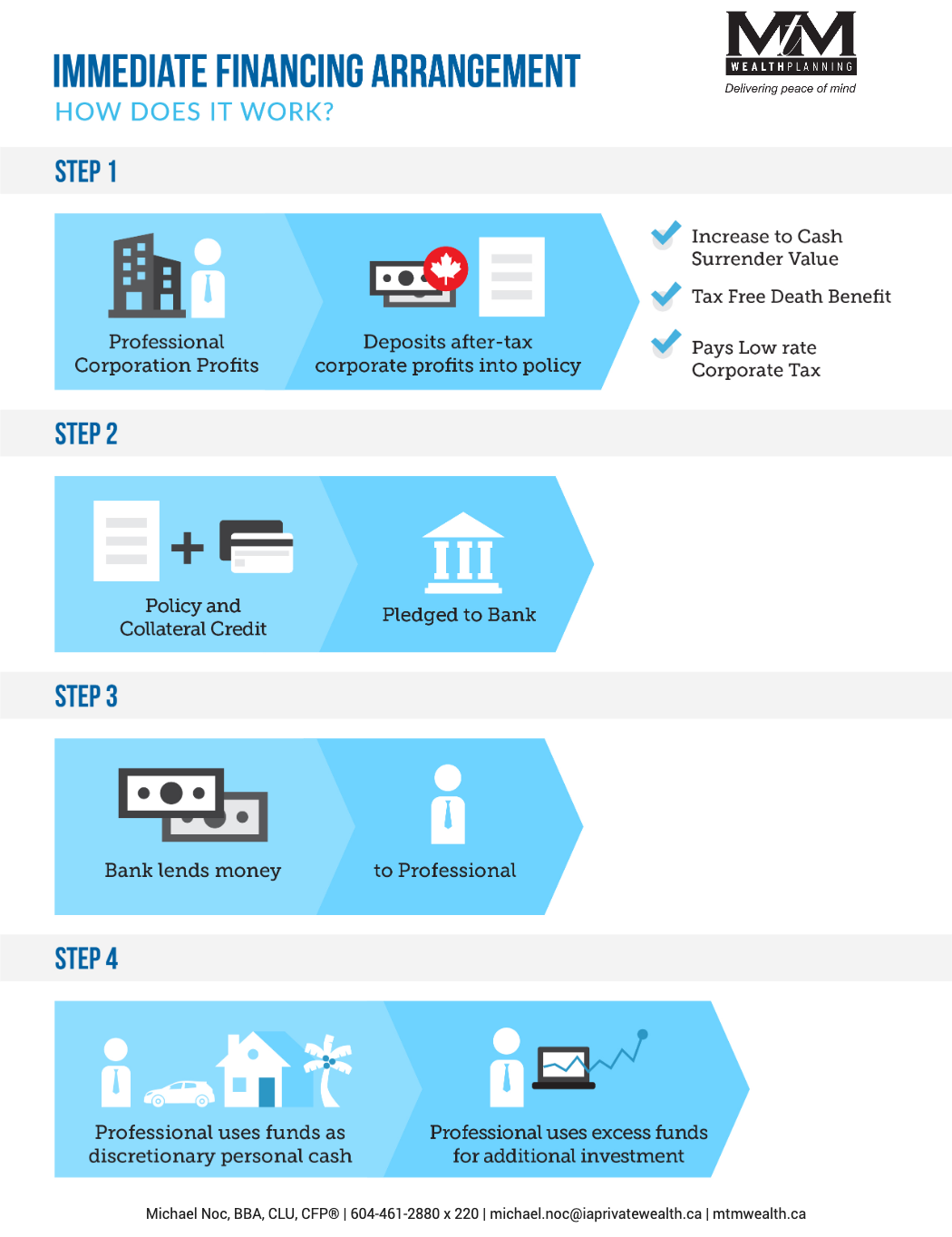

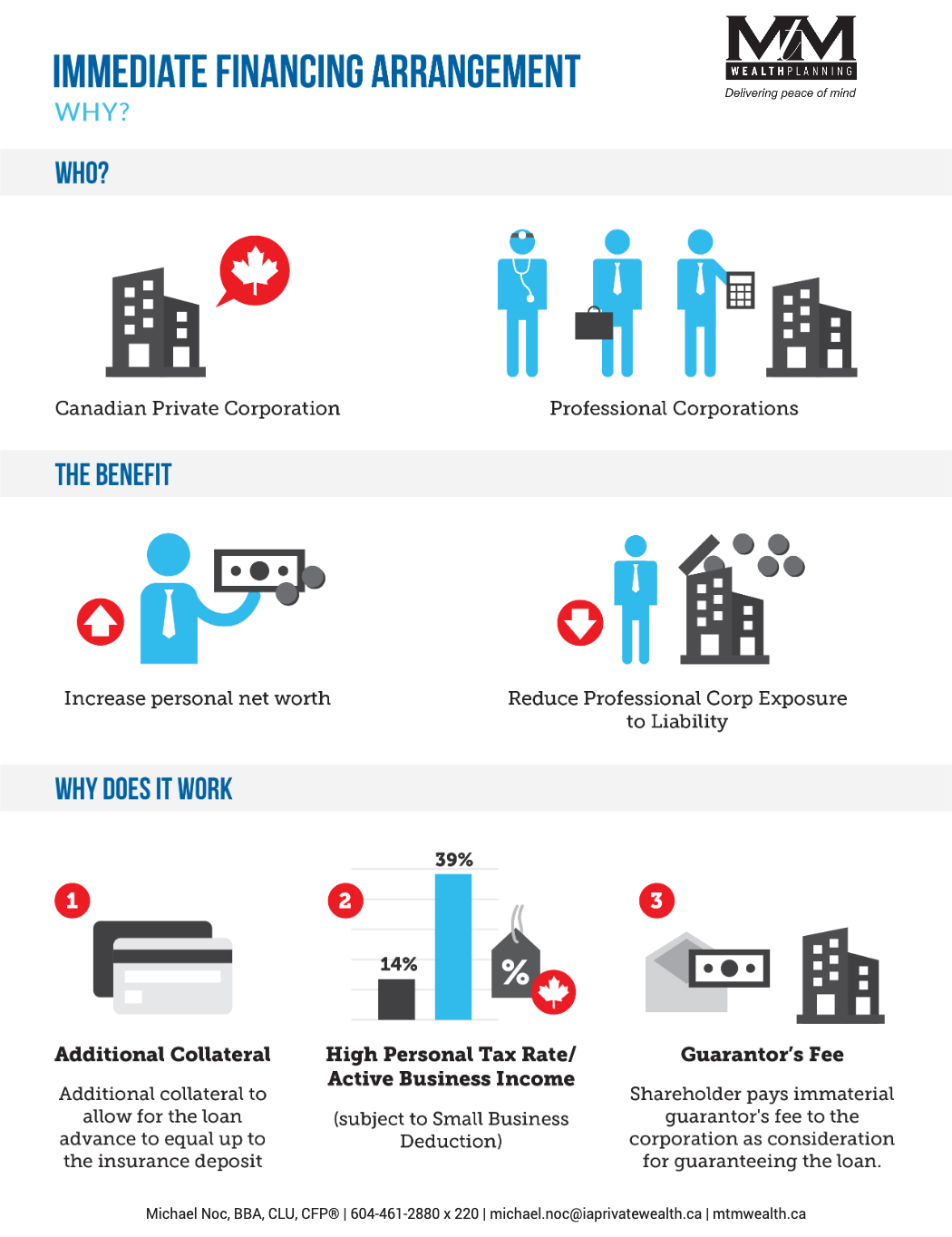

You can use the policy to build up a cash value – making it a good choice for low-risk investing.

-

You may be able to use your permanent life insurance policy as collateral for a loan, making it a good choice for business owners.

The main drawback to permanent life insurance policies is that the premiums are often more expensive than term life insurance premiums. If, however, you’re thinking long-term and can afford the premiums, permanent life insurance may be a great way to ensure you’re always protected.

Term life insurance

Term life insurance is either valid for a set amount of time (such as five or ten years) or until you reach a set age – for example, 60. You should generally be able to renew your life insurance at the end of each term, but your premiums may go up.

Term life insurance premiums are cheaper than permanent life insurance premiums – at least, you are younger and healthier (as the risk of you dying is lower). Your premiums will increase as you age or develop health issues.

You can’t use term life insurance as collateral for a loan or use the policy to build up a cash value. There are lots of benefits to term life insurance, though – it’s a good choice for you if you want low premiums, easy-to-understand insurance, and only need it for a set amount of time – such as while you have a mortgage or young children.

We can help you decide between permanent and term life insurance

If you’re not sure what kind of life insurance is best for you, we can help. We’re happy to talk to you to get more information about your insurance needs. We can then discuss what each type of insurance will cost you and which type of insurance we feel is best for you.

Give us a call today!